Modern day gold has many technological, medical, and popular culture uses such a jewelry, pottery, and clothing, but some of its most prominent uses can be found in inflation protection through the purchase of gold bars and coins.

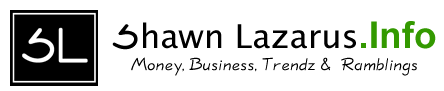

There are 3 BIG reasons why storing your savings in gold can protect your financial future:

- Gold has maintained its purchasing power over the ages. For example: one ounce of gold used to be able to buy you a suit in New York City. Today it still can!

- The US Dollar has lost over 98% of its purchasing power over the last 100 years. It's important to diversify your savings.

- While the US Dollar has lost much of its value, several other countries around the world have experienced economic collapses. Gold protects your wealth around the world, and it's an internationally recognized investment.

Things leading up to your reality:

Joe Biden is claiming victory as the 46th President of the United States. Right now it doesn't really feel like our states are united and one may argue that we are more divided than ever.

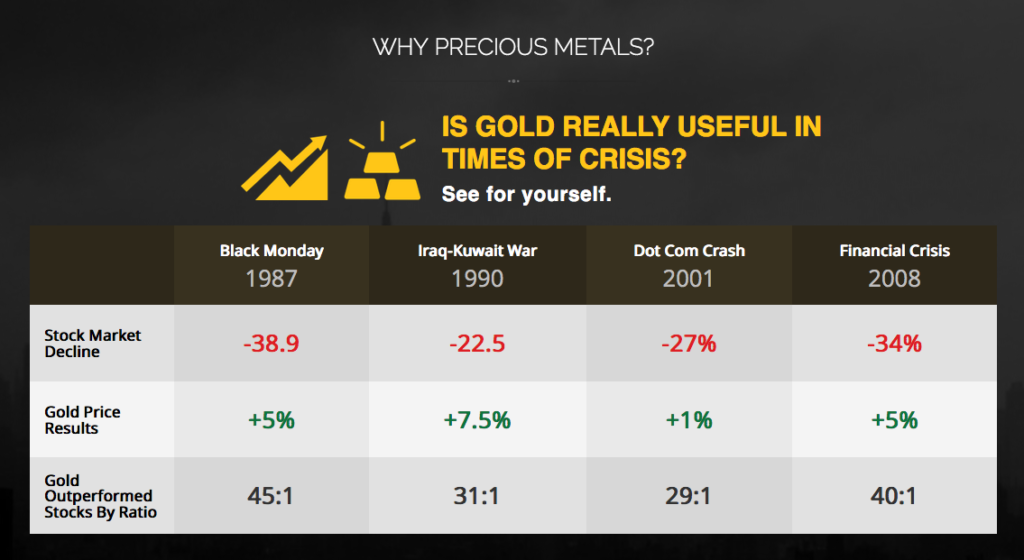

Rightfully, President Trump is not ready to concede and is likely to contest the election, perhaps all the way up to inauguration day on January 20, 2021. In financial market terms, this could feel like an eternity. All things social and economic are expected to be unsteady from now until then. Financial analysts' dire predictions appear to be coming true right before our eyes. You may see it, but are you really paying attention?

In the weeks preceding election day, financial outlets and news pundits told us that a protracted and unclear election would be the worst possible outcome for the broader markets and, if Bush v. Gore is any precedent, markets could dramatically drop 20% within as little as a month.

https://www.zerohedge.com/markets/wall-street-braces-terrifying-risk-and-20-plunge-just-few-days

Moreover, coupled with Team Biden's aggressive social programs coming down the pipeline, there's the potential for a US dollar catastrophe. Money-printing potential (Quantitative Easing) has never been greater and a devaluation of the Dollar as the world's reserve currency could be imminent. Historically, gold and the Dollar have had an inverse relationship so, if that holds true, as the Dollar devalues, gold will continue to rise. These are basic market fundamentals, which don't even take into account the supply and demand aspect of heightened investor interest for precious metals.

COVID-related lockdowns are taking place all over Europe again, resulting in mass disruption and panic. We've seen this phenomenon before: an East to West sweep of alarmist and overreaching COVID responses.

Since Team Biden spent the last 2 months attacking the Trump administration's response to COVID, we believe it's only a matter of time before Biden's administration seeks to take drastic action to combat the spread. What else can they do?

They really don't have an option other than an aggressive lock-down type response or they will be labeled as hypocrites. We all saw what COVID did to the Dow Jones in March and April of this year. Are you prepared for the same or maybe even worse this time?

Remember, being prepared isn't only an emotional state of mind — it is also being adequately positioned in the event of another market downturn or civil unrest.

Precious metals stand to be the benefactor as investors and collectors alike turn to these safe-haven assets that have been trusted for thousands of years. Reports of gold at $2,500 per ounce in the near term are beginning to emerge.

https://seekingalpha.com/article/4386279-gold-investors-might-soon-see-price-of-2500-per-ounce

Additionally, there are many positive examples of silver's future potential as both a safe-haven asset and industrial metal that could benefit greatly if Team Biden's Green New Deal comes to fruition.

https://www.nasdaq.com/articles/renewed-demand-for-safe-havens-will-boost-silver-2020-11-02

https://www.foxbusiness.com/markets/biden-green-new-deal-silver-prices-bank-of-america

Experts, including Fox Business, even argued that no matter who the real winner for Presidency is gold and precious metals will perform well regardless of who takes office.

https://www.foxbusiness.com/markets/commodities-bull-market-is-coming-goldman-sachs

You may or may not be a current investor in precious metals at the moment. If you didn't purchase gold or silver yet, what's stopping you?

If you did purchase, did you purchase enough?

Is a $5.00/month insurance premium enough to protect you if your financial house is burning down around you?

I recommend up to 20% of your overall investment portfolio to be in precious metals as an appropriate hedge against financial instability.

👇 See this video below to figure out if gold or silver or both would be a wise benefit to your financial future in case the dollar tanks further down the hole…

Founder of Lazarus Enterprises Group and head of strategy at Apex Media 365, also Apex Marketing Pro, a leading digital marketing firm.

We developed a system to help small businesses, and local companies connect with potential clients, and customers who truly need their goods or services, which will in-turn increase the company’s net worth with a lot more ease, and control.

We do this utilizing Gorilla marketing tactics, and technology to measure a return on investment.

To schedule a free 30-minute Marketing Tune-up, call us: 1-888-256-4202